- ( 0 Reviews )

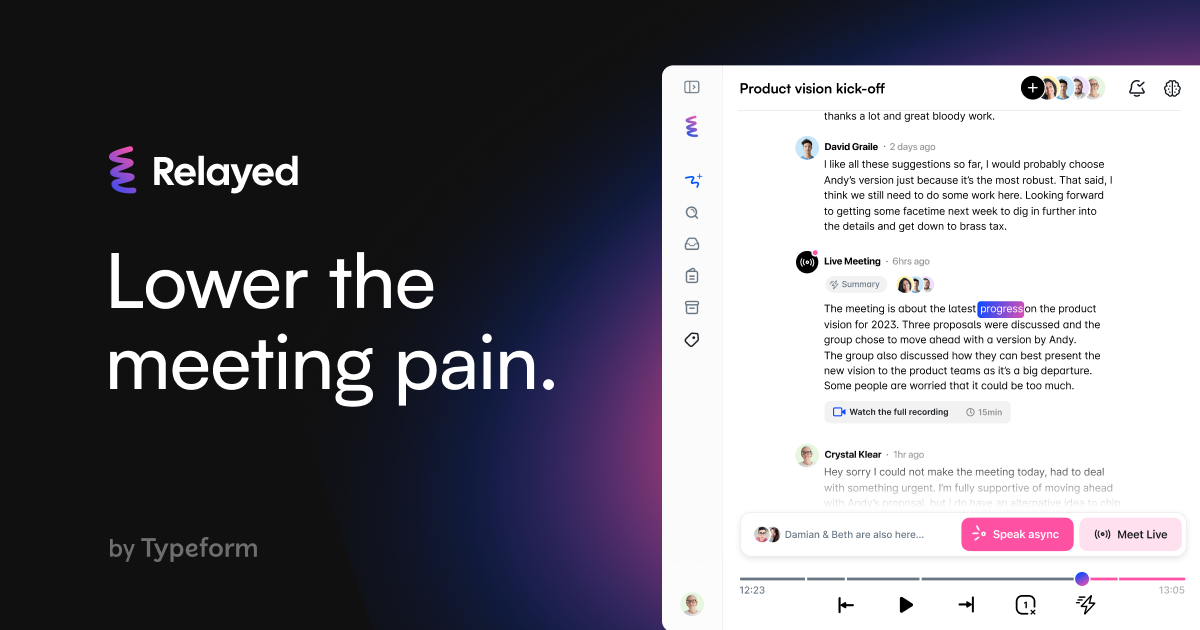

Checkout Relay – Investment Portfolio Analyzer

Product Description

AngelList Relay is an AI-powered tool that automatically extracts key information from investment documents and company updates, including pay-to-play provisions, revenue metrics, and other important data, allowing users to forward emails to a designated email address for analysis. It also offers a portfolio tracking dashboard and team permissioning features.

Other Product Information

- Product Category: Finance

- Product Pricing Model: Freemium

Ideal Users

- Investment Analyst

- Venture Capitalist

- Private Equity Firm

- Angel Investor

- Hedge Fund Manager

Ideal Use Cases

For Venture Capitalist

- Analyzing Investment Performance: As a venture capitalist, one should use AngelList Relay to analyze the performance of portfolio companies by extracting key details such as pay-to-play provisions, revenue metrics, and burn rate from investment documents and company updates to make informed decisions about future investments.

- Monitoring Portfolio Companies: one should use AngelList Relay to track the progress of portfolio companies and stay updated on their performance through access to historical portfolio company updates and investment documents.

- Streamlining Investment Process: one should use AngelList Relay to automate the process of extracting important data from investment documents and company updates, reducing the time and effort required for manual data entry.

- Collaborating with Teams: one should use AngelList Relay’s team permissioning feature to share information with team members and keep them updated on portfolio companies’ performance.

- Organizing Portfolio Information: one should use AngelList Relay to organize all portfolio information in one centralized location for easy access and tracking.

For Private Equity Firm

- Analyzing Portfolio Performance: Private equity firms can use AngelList Relay to track the performance of their investments by monitoring key metrics such as revenue growth, burn rate, and pay-to-play provisions in real-time, allowing them to make informed decisions about portfolio companies’ health and potential investment opportunities.

- Streamlining Due Diligence: Private equity firms can use AngelList Relay to automate the process of reviewing investment documents and company updates, saving time and resources by extracting important data from emails and organizing it into a structured format for easy analysis.

- Investor Relations: Private equity firms can use AngelList Relay to keep investors informed about portfolio companies’ progress and performance through regular updates and reports.

- Portfolio Management: Private equity firms can use AngelList Relay to manage their portfolio by tracking key metrics and making data-driven decisions for investment opportunities.

- Investment Research: Private equity firms can use AngelList Relay to research potential investments by analyzing historical data and company updates, and make informed decisions about which companies to invest in.

For Angel Investor

- Due Diligence: As an angel investor, one should use AngelList Relay to perform due diligence on potential investments by analyzing the key details extracted from investment documents and company updates to make informed decisions about which companies to invest in.

- Portfolio Management: one should use AngelList Relay to track portfolio’s performance and monitor key metrics of investments.

- Investment Research: one should use AngelList Relay to research new investment opportunities by analyzing historical data and company updates.

- Deal Analysis: one should use AngelList Relay to analyze the pay-to-play provisions and revenue metrics of potential deals to make informed decisions about which deals to invest in.

- Investor Networking: one should use AngelList Relay to connect with other investors and share information about portfolio companies with them.