- ( 0 Reviews )

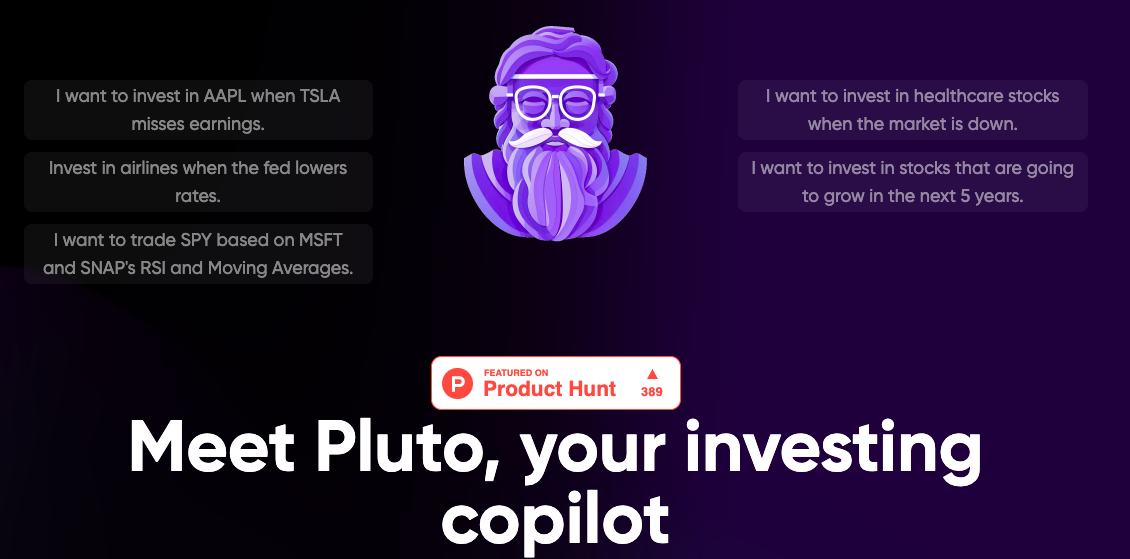

Checkout Pluto – Investment Decision Making Platform for Confident Trading

Product Description

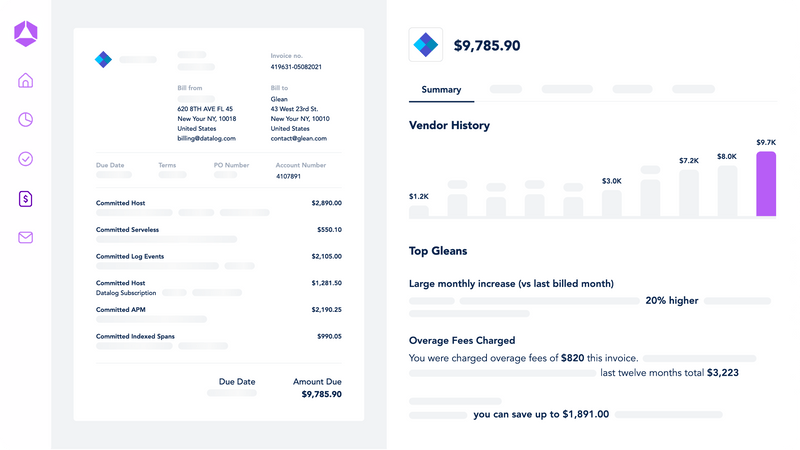

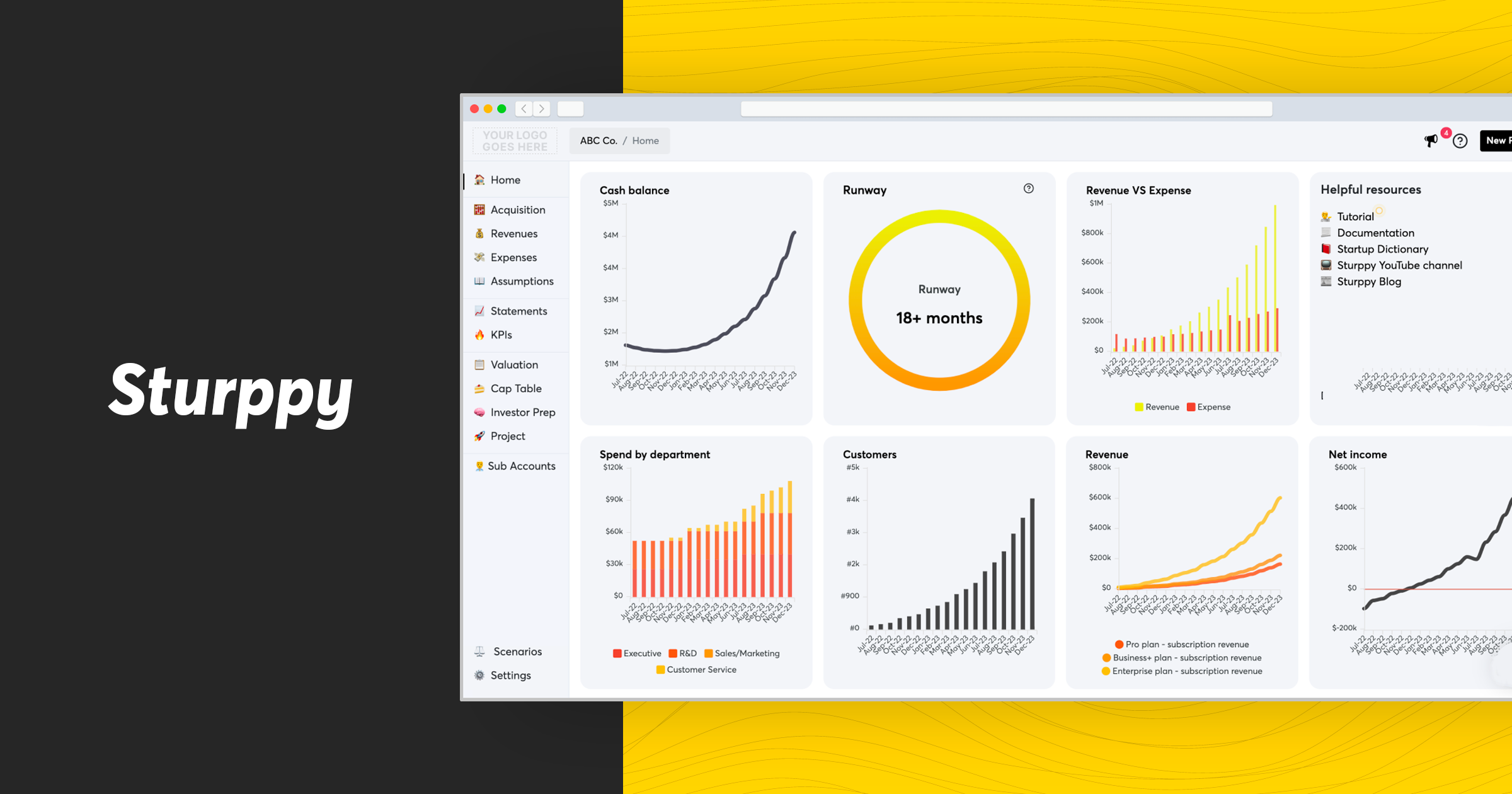

The Pluto platform is an AI-driven investment tool that offers a comprehensive solution for users to make informed decisions by providing real-time data, intelligent insights, and an intuitive interface for executing trades using smart automations. It features an integrated assistant named Plato, which utilizes advanced algorithms to analyze financial information and offer personalized recommendations.

Other Product Information

- Product Category: Finance

- Product Pricing Model: Freemium

Ideal Users

- Financial Analyst

- Investment Advisor

- Portfolio Manager

- Stock Broker

- Wealth Manager

Ideal Use Cases

For Financial Analyst

- Analyzing investment portfolios: As a Financial Analyst, one should use Pluto to analyze client’s investment portfolios and provide recommendations for optimization based on real-time data and actionable insights to improve their returns.

- Investment Planning: one should use the platform to create personalized investment plans for clients based on their financial goals and risk tolerance.

- Automated Trading: one should use Pluto’s intelligent automation feature to execute trades on behalf of clients, saving time and reducing the risk of human error.

- Portfolio Rebalancing: one should use Pluto to automatically rebalance portfolios to maintain optimal asset allocation.

- Investment Research: one should use Pluto’s data visualization tools to analyze market trends and identify potential investment opportunities clients.

For Investment Advisor

- As an Investment Advisor, one should use Pluto to help clients make informed investment decisions by analyzing their financial goals and risk tolerance, and creating customized portfolios based on their unique needs and preferences, using the platform’s AI-powered data visualizations and intelligent assistant, Plato.

- As an Investment Advisor, one should use Pluto to monitor clients’ investments and provide them with real-time updates on market trends and performance, allowing them to make timely adjustments to their portfolios as needed.

- As an Investment Advisor, one should use Pluto to automate the execution of trades clients, ensuring they are executed at optimal times and prices.

- As an Investment Advisor, one should use Pluto to provide clients with future insights on potential investment opportunities and risks, allowing them to make informed decisions about their financial journey.

- As an Investment Advisor, one should use Pluto to help clients track their investments and manage their portfolios, providing them with a comprehensive view of their financial performance and growth.

For Portfolio Manager

- As a Portfolio Manager, one should use Pluto to analyze market trends and make informed investment decisions clients by leveraging its AI-powered data visualizations and intelligent assistant, Plato, to help understand the current market conditions and identify potential investment opportunities.

- one should use Pluto to automate client’s investment process, reducing the time and effort required for manual trading and increasing efficiency.

- one should use Pluto to create customized investment portfolios based on their risk tolerance and financial goals.

- one should use Pluto to monitor and manage clients’ investments, providing them with regular updates on performance and insights.

- one should use Pluto to provide personalized recommendations for portfolio rebalancing and optimization.

For Stock Broker

- Investment Portfolio Management: As a stock broker, one should use Pluto to manage clients’ investment portfolios by utilizing its intelligent assistant, Plato, to analyze their financial data and provide personalized recommendations based on their risk tolerance and goals, making informed decisions about buying and selling stocks, bonds, mutual funds, and other securities.

- Financial Planning: one should use Pluto to help clients plan for their future by analyzing their current financial situation and creating a customized investment strategy that aligns with their long-term financial goals and risk tolerance.

- Retirement Planning: one should use Pluto to assist clients in planning for their retirement by providing insights into various investment options and automating the execution of their retirement accounts, such as 401(k)s and IRAs.

- Wealth Management: one should use Pluto to manage clients’ wealth by analyzing their financial data and creating a diversified portfolio that maximizes returns while minimizing risk.

- Automated Trading: one should use Pluto to automate the execution of trades clients, allowing them to invest in stocks, bonds, and other securities based on market trends and insights generated by the platform’s AI-powered data visualizations.